Understand China’s Trade Flow: Yearly Trends, Market Growth, and Key Insights

August 14, 2024

The Insider’s Guide to Import Baby Products from China

September 9, 2024China's 2024 Export Boom: Unpacking the H1 Trade Surge

In the first half of 2024, China’s foreign trade reached an impressive US$2.98 trillion, reflecting a 2.9% year-on-year growth in dollar terms and resulting in a trade surplus of US$435 billion, an 8.6% increase from the previous year. When measured in RMB, the trade expansion is even more pronounced, with a 6.1% year-on-year surge. This growth underscores China’s strong performance in a challenging global trade environment, further accelerating its economic momentum.

Trade dynamics have evolved, with ASEAN holding its position as China’s top trading partner, while trade with the EU saw a minor decline. Meanwhile, trade with the U.S. and South Korea showed mixed trends. Notably, trade with Belt and Road Initiative (BRI) countries surged by 7.2%, highlighting the growing importance of these regions in China’s trade network.

China's H1 2024 Export Performance: Key Highlights and Insights

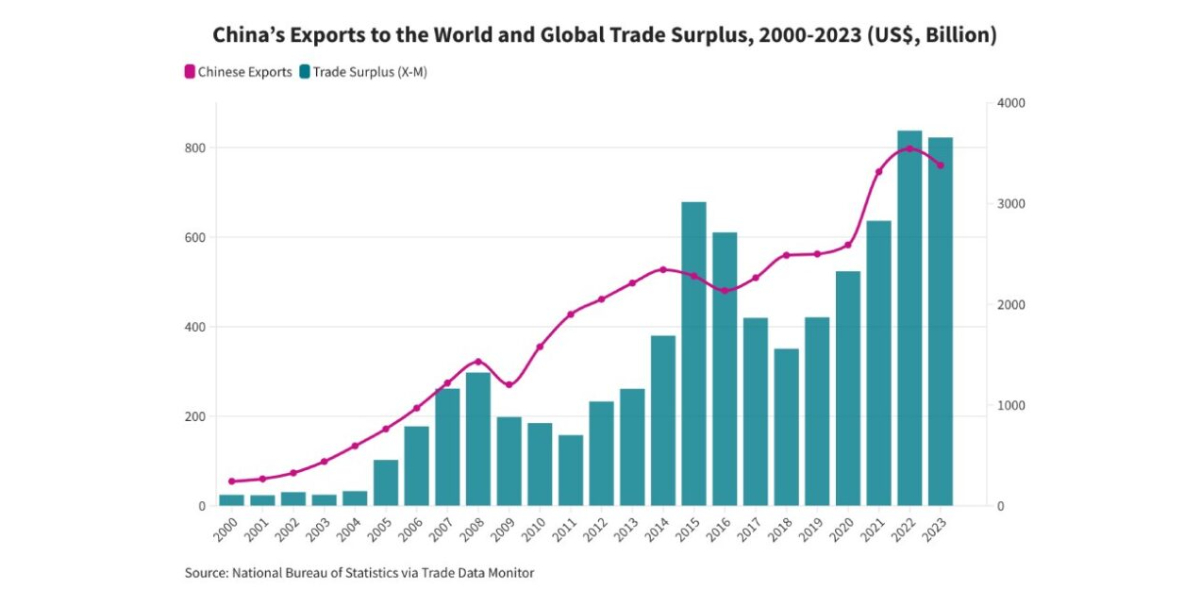

China’s export performance has captured significant attention, reflecting a remarkable growth trajectory in recent years. From 2019 to 2023, China's global exports surged by 35.2%, reaching an impressive US$3.38 trillion.

This growth momentum continued into the first half of 2024, with exports rising by 3.8% year-on-year in dollar terms, totaling US$1.71 trillion. Notably, June 2024 marked a record monthly trade surplus of US$99 billion, as reported by fDi Intelligence, highlighting China's robust position in the global trade landscape.

China’s export growth is evident in its expanded reach, with exports increasing to 202 out of 233 countries and regions between the first half of 2019 and the first half of 2024. This broad expansion underscores China's strategic efforts to diversify its trade partnerships and enhance its global economic influence. Although exports saw a 4.6% decline in 2023, the three-year moving average of Chinese exports reached a record US$3.41 trillion for the 2021-2023 period, reinforcing China’s central role in the global economy.

Who are China’s major trade partners ?

In the first half of 2024, China’s trade dynamics show notable growth in engagement with ASEAN and Latin America. However, trade with the EU, the US, Japan, and Australia has experienced a decline.

Trade with ASEAN countries rose by 7.1% year-on-year, reaching US$472.45 billion, with Vietnam leading the way with an impressive 20.6% growth. Meanwhile, trade between China and Latin America grew by 7.4% year-on-year, totaling US$252 billion, fueled by a strong 11.3% increase in exports.

Trade with Regional Comprehensive Economic Partnership (RCEP) countries saw modest growth, reaching US$899.36 billion from January to June 2024, a 1.59% increase. Exports to RCEP members grew by 2.52% year-on-year, totaling US$470.25 billion.

Conversely, trade with Western economies declined. Trade with the EU fell by 3.7% to US$382.39 billion, with exports down by 2.6% and imports decreasing by 5.7%. Trade with the US remained relatively stable at US$322.63 billion, showing a slight yearly decrease of 0.2%, despite a 1.5% rise in exports.

Trade with Japan and Australia also declined, with Japan experiencing a 5.1% drop to US$148.59 billion, and Australia seeing a 5.1% decrease to US$109.60 billion. Both countries saw reductions in exports and imports.

Which Chinese provinces are exporting the most ?

In the first half of 2024, China's export performance varied significantly across provinces, showcasing notable regional contributions and growth rates. Out of all provinces, 22 experienced year-on-year increases in trade volumes, with 11 achieving impressive double-digit growth.

This analysis of provincial export data for the first half of 2024 is presented in Renminbi (RMB) rather than US dollars, reflecting the availability of data in RMB terms.

Guangdong: China’s Top Export Leader

Guangdong, China's premier export province, maintained its leading position with impressive results in the first half of 2024. The province's total trade value reached RMB 4.37 trillion (US$601.73 billion), representing a substantial 13.8% increase from the previous year. This remarkable growth highlights Guangdong’s vital role in China’s trade ecosystem.

Several factors contributed to Guangdong’s exceptional export performance:

- Rising Demand: The global economic rebound post-pandemic has driven increased demand for Guangdong’s products.

- Competitive Advantage: The province has bolstered its international competitiveness, with notable export increases in ships (up 70.7%), electric passenger vehicles (up 78.3%), and containers (up 104%).

- Emerging Trade Sectors: Guangdong has experienced rapid expansion in new trade sectors, including electric vehicles and cross-border e-commerce, which have become significant contributors to its export success.

- Private Sector Growth: The dynamism of Guangdong’s private enterprises has played a crucial role, with private sector exports growing by 21.3%.

Zhejiang: Steady Growth Amid Evolving Trade Dynamics

Zhejiang province showcased robust performance, with its total trade value reaching RMB 2.56 trillion (US$352.50 billion), marking a 7.8% year-on-year increase. The province's exports alone rose by 8.6%, totaling RMB 1.90 trillion (US$261.62 billion).

Key factors driving Zhejiang’s export growth include:

- Sectoral Strength: Zhejiang saw substantial growth in high-value exports, including ships (up 93.7%) and automatic data processing equipment (up 43.1%).

- Market Expansion: The province has proactively explored new markets and adjusted to global demand shifts, contributing to its sustained export success.

Key factors driving the YRD’s outstanding performance include:

- Advanced Infrastructure and Industry: The region's sophisticated infrastructure, extensive manufacturing capabilities, and robust innovation ecosystems play a crucial role in its trade success.

- Supportive Policies: Strategic regional policies and a favorable business climate have significantly enhanced trade performance.

The Impact of Private Enterprises on Export Growth

Private enterprises have become key drivers of export growth across China. In Guangdong, private firms were responsible for 64% of the province's total exports. Likewise, private businesses in Zhejiang and Shandong have made substantial contributions to their respective export performances. This trend underscores the increasing influence of the private sector in China’s trade landscape, driven by enhanced business environments and strategic international engagement.